An analysis of practice shows that individual companies use this system for fictitious documentation of turnover, without ensuring the real fulfillment of tax obligations.

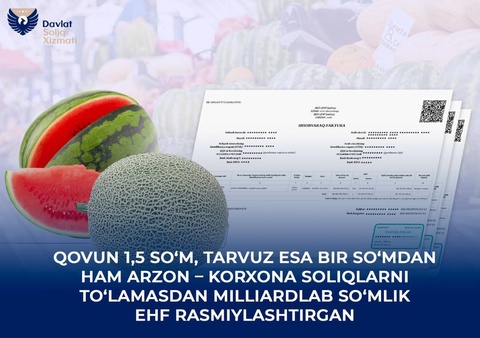

So, in June 2025, the limited liability company Businessman was registered (the name has been changed), declared as a participant in the non-specialized wholesale trade. Already in July and August, this organization, without a single employee on staff, without leased or on-balance real estate and vehicles, issued electronic invoices for the sale of highly liquid goods - food, building materials, spare parts and other items - totaling 111.5 billion soums, including VAT added value in the amount of 12 billion soums. As a result, the legal entity has a debt to the budget in the amount of about 12 billion soums, which has not yet been repaid.

A similar situation has been recorded with respect to another organization, Tadbirkorman LLC (name changed), established in June 2022 to conduct wholesale trade. With an authorized capital of only 10 million soums, in July-August 2025, the company issued an ESF for the sale of similar highly liquid goods in the amount of 29.6 billion soums, including VAT in the amount of 3.2 billion soums. At the same time, the company also did not own or lease property, vehicles, or staff. As in the previous case, the accrued taxes were not paid to the budget, which led to the formation of debts in the amount of about 17 billion soums.

The identification of such facts became possible due to the functioning of a special information and analytical system. It automatically analyzes digital data, identifies atypical turnover patterns, and determines the level of risk from electronic invoices. This mechanism allows for timely detection of suspicious transactions, reducing the likelihood of tax evasion.

It should be noted that the ESF risk assessment system is currently operating in a test mode. In this regard, no enforcement measures have yet been applied to the identified facts, but such examples show the high effectiveness of digital tax control tools.

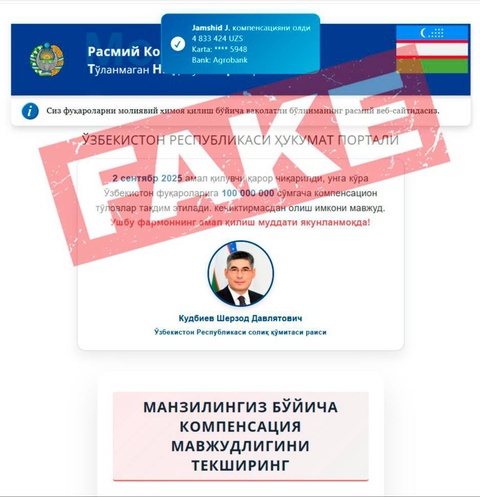

The Tax Committee reminds business entities of the need to conduct business in good faith, pay taxes on time and issue electronic invoices correctly. Otherwise, after the testing of the system is completed, liability measures provided for by law will be applied for violations.