Such facts are identified using a special information and analytical system, which, based on the analysis of available digital data, automatically determines the risk level of the ESF in real time.

For example, in August 2025, Savdo LLC was established (the name has been changed) to carry out wholesale trade activities with an authorized capital of 10 million soums.

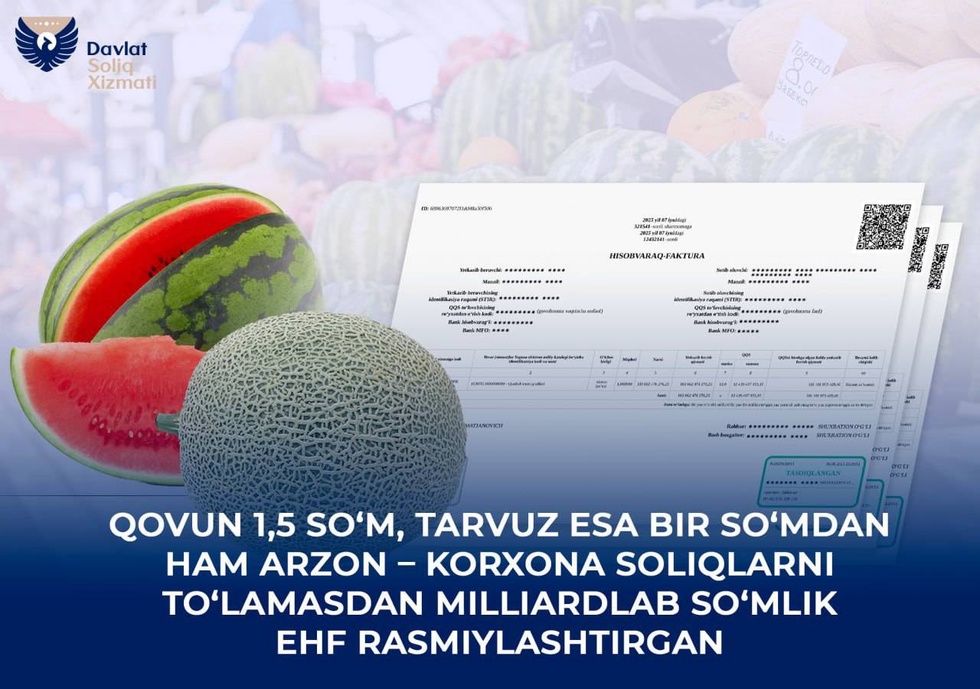

In August-September 2025, the company, without employees, property or vehicles owned or leased, issued electronic invoices for various types of goods totaling 1.2 billion soums, including 123.5 million soums of VAT. At the same time, the cost of the goods sold did not correspond to their market price. For example, these ESFS indicate that 127 thousand melons were sold at a price of 1.5 to 16.4 soums and 124 thousand watermelons at a price of 0.9 to 27 soums per piece.

During the entire period of activity, taxes were not paid to the budget at all and arrears were incurred.

The Tax Committee recalls that a special information system for determining the risk level of the ESF is currently running in a test mode and no measures have been applied to the identified violations.