If a citizen is engaged in a type of activity that falls under the list of 101 types of activities (works, services) provided for by Decree of the President of the Republic of Uzbekistan dated June 8, 2020 No. 4742 "On measures to simplify state regulation of entrepreneurial activity and self-employment", he is registered as a self-employed employed person in accordance with the established procedure and pays social tax of at least 1 BRV (the base calculated value is 340 thousand soums), he is credited with 1 year of work experience.

Thus, a citizen will have the right to receive a pension in the future if he pays social tax to the Pension Fund every year for 7 years as a self-employed person.

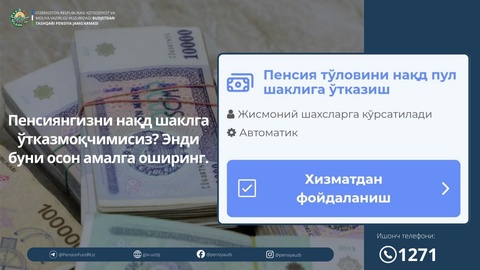

Currently, the minimum old-age pension for a period of part-time work is 621 thousand soums per month, including an additional payment. The amount of the pension depends on salary and work experience.

Where should citizens who want to get work experience apply by paying this type of social tax?

Citizens wishing to obtain work experience by paying this type of social tax can apply to the Center for Public Services and Tax Authorities at their place of residence or online through the Unified Portal of Interactive Public Services.