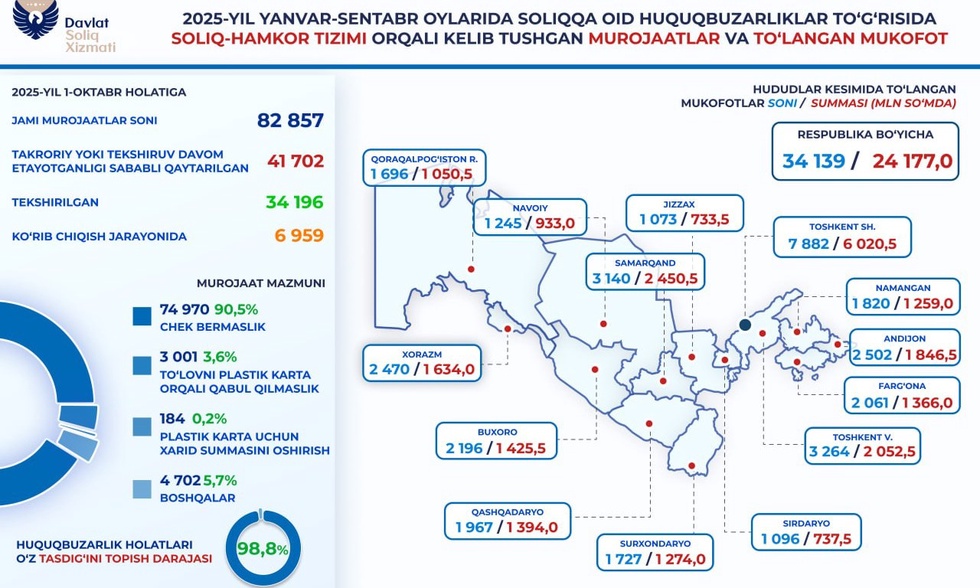

Of these, 74 970 appeals were related to non-issuance of a purchase receipt, 3 001 to refusal to accept payment by plastic card, 184 to increasing the purchase amount for plastic card, and 4 702 to other types of violations.

41 702 of the appeals were not reviewed due to being repetitive or because an inspection was ongoing at the business entity against which the complaint was submitted.

Based on the appeals, 34 196 tax inspections were carried out, and violations were confirmed in 98,8% of cases.

For reporting violation cases, a reward of 24.1 billion sum was paid to citizens in 34 139 situations (20 percent of the collected fine amount).