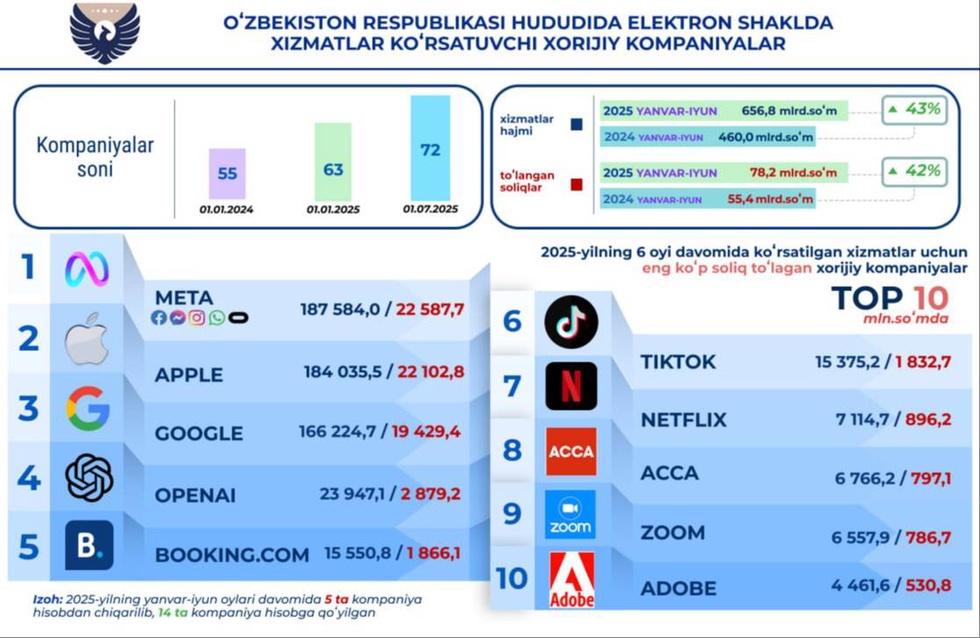

According to the Tax Committee, 94% of the taxes paid are accounted for by 10 foreign companies providing electronic services.:

Meta - 22.6 billion soums;

Apple - 22.1 billion soums;

Google - 19.4 billion soums;

OpenAI - 2.9 billion soums;

Bitcoin.com - 1.9 billion soums;

TikTok - 1.8 billion soums;

Netflix - 896.2 million soums;

Acca - 797.1 million soums;

Zoom - 786.7 million soums;

Adobe - 530.8 million soums.

Foreign legal entities providing services in electronic form submit tax reports and pay taxes no later than the 20th day of the month following the expired quarter.