According to the Regulations, the lessor is obliged to register the real estate contract with the tax authority no later than 3 days from the date of its conclusion.

There is no fee for registration of the contract.

Real estate can be leased for a secondary lease (for free use) by the person who received it for a primary lease (for free use). Secondary leases should also be accounted for by the tax authorities.

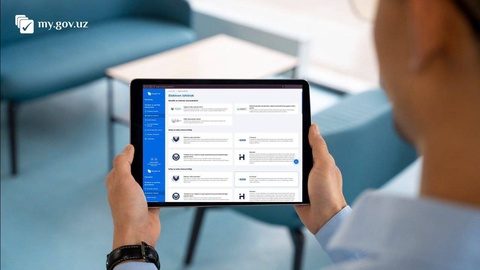

Registration of the contract is carried out only in electronic form through the information system of the State Tax Committee.

The contract sent by the lessor through the system will not be taken into account by the tax authorities if the lessee does not confirm it within 5 days.

When the contract is registered, a certificate with a QR code is issued.

If the contract is terminated prematurely or invalidated by agreement of the parties or otherwise, it will be written off by the lessor online, the Ministry of Justice informs.